Monday Morning Links 2023 Week 26

Global stock-related links

Americas:

Yet Another Value Blog on Coinbase (🇺🇸 COIN US - US$14 billion)

JustValue on Academy Sports & Outdoor (🇺🇸 ASO US - US$3.8 billion)

Canadian Value Stocks on Smartcentres REIT (🇨🇦 SRU-U CN - US$3.0 billion)

Short-seller Pig Farmer Capital on Enovix (🇺🇸 ENVX US - US$2.2 billion)

Moram on McDonald’s franchisee Arcos Dorados (🇧🇷 ARCO US - US$2.1 billion)

Hurdle Rate on asset manager CI Financial (🇨🇦 CIX CN - US$2.0 billion)

Value Don't Lie on spin-off Atmus Filtration (🇺🇸 ATMU US - US$1.8 billion)

Invariant on second-hand retailer Winmark (🇺🇸 WINA US - US$1.2 billion)

Redditor u/Outside_Ad_1447 on Algoma Steel (🇺🇸 ASTL US - US$721 million)

Clark Street: update on Magenta Therapeutics (🇺🇸 MGTA US - US$40 million)

Europe:

Gotham City Research on SES-Imagotag (🇫🇷 SESL FP - US$1.2 billion)

Hurdle Rate on Openjobmetis (🇮🇹 OJM IM - US$129 million)

Hurdle Rate on Anexo Group (🇬🇧 ANX LN - US$96 million)

Breeley Capital on tinyBuild (🇬🇧 TBLD LN - US$87 million)

Asia-Pacific:

Abilitato with an update on Makita (🇯🇵 6586 JP - US$7.8 billion) (German)

Overlooked and Undervalued on Sierra Rutile (🇦🇺 SRX AU - US$64 million)

Trephine on 1st Group (🇦🇺 1ST AU - US$4 million)

(estimated reading time)

Charles Gave sees the world breaking up into three currency zones (18 mins)

George Magnus: China will not be able to de-dollarize under Xi Jinping (15 mins)

Florian Kronawitter is negative on the European business cycle (9 mins)

Apricitas Economics: US supply chains are healing (6 mins)

Searching 4 Value blog’s review of Giroux’s book Capital Allocation (7 pages)

Donville Kent with his May 2023 investor letter (8 mins)

Crescat Capital is bearish equities & bullish gold & other commodities (11 mins)

Stephen Clapham: Will private equity blow up in 2024? (5 mins)

Verdad’s Dan Rasmussen: There is no easy way out for PE funds (4 mins)

Platinum is bearish developed market equities, bullish Chinese (12 mins)

Undervalued Shares: Russian ADRs and GDRs: What’s next? (13 mins)

Peter Bernstein’s checklist for growth companies (3 mins)

Peter Lynch: Charlie Silk’s 150-bagger (2 pages) (h/t: Compounder Fund)

(listening time)

Mark Mobius: “We are not ignoring China” (4 mins)

Nassim Taleb went on CNBC trashing cryptocurrencies (15 mins)

Former Bridgewater PM Bob Elliott on his macro outlook (54 mins)

Senior Fed adviser Josh Younger on the Eurodollar market (55 mins)

Richard Bookstaber on building risks in the global economy (26 mins)

Warren Pies on the recent strength in the US housing market (34 mins)

Private equity titan Eric Resnick on the travel & leisure market (59 mins)

John Spears of Tweedy, Browne on the opportunity set in value stocks (32 mins)

Premier Miton Investors’ Gervais Williams is bullish on UK stocks (47 mins)

Deuterium Capital’s Osman Ozsan on the HKD, China and commodities (53 mins)

Leigh Goering on what he argues is a building global food crisis (1:04 hours)

Joe Studwell on economic development in Asia and Africa (45 mins)

Saga Partners’ Joe Frankenfield on TV streaming enabler Roku (42 mins)

Bill Nygren providing a deep-dive on First Citizens Bank (52 mins)

Michael Dunne & Chris Donovan on Chinese EV maker BYD’s history (35 mins)

Professor Meir Statman on the basics of behavioural investing (1:11 hours)

Anthony Scilipoti of Veritas: “Investing Like a Forensic Accountant” (44 mins)

Alix Pasquet III on how to be a great analyst (56 mins)

Interested in Asian equities? Check out my sister publication Asian Century Stocks, which provides deep-dives on value stocks in the Asia-Pacific region:

Disclaimer: Monday Morning Links uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers, including whether any investment suits your specific needs. From time to time, I may have positions in the securities covered in the articles on this website.

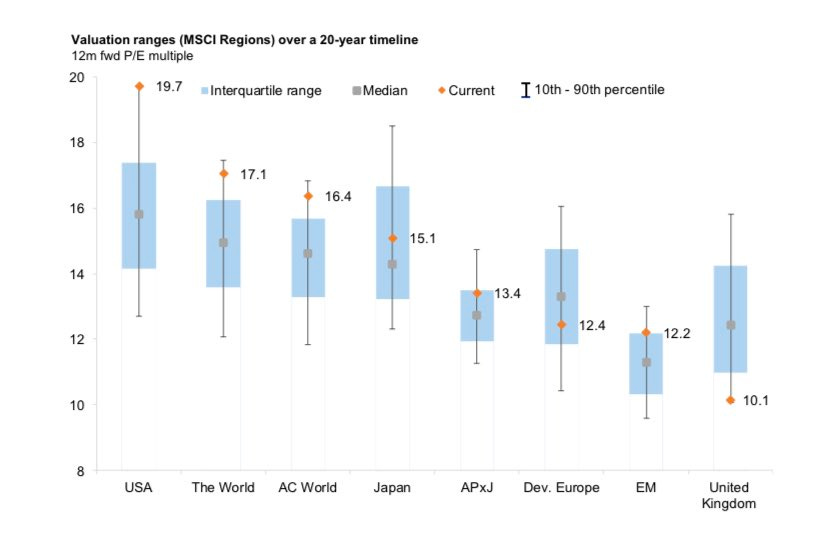

Great list Michael. Although the P/E should not be used in isolation, the current valuation levels seem very appealing for UK.

Another great list! Thank you for the inclusion!