Monday Morning Links Week 1

Global stock-related links

Happy New Year! 🎉

Check out the interview with Steve Mandel. What I found fascinating about it is that Mandel’s fund, Lone Pine, pays a great deal of attention to company culture in their investments: what kind of people work there, how they think, what they’re motivated by, etc. That’s served them well with a ~20% CAGR since inception. Mandel likes biographies and recommended those of Ulysses Grant, Abraham Lincoln and Sam Walton.

I found the below idea on Scott’s Liquid Gold fascinating. It’s a consumer products company that’s divested its assets, now left only with a pet business bringing in US$4 million in revenues per year and cash of US$4.4 million (against a market cap of US$12 million). Maran Capital’s Dan Roller has been buying heavily. A few days ago, Scott’s Liquid Gold announced a merger with Horizon Kinetics, a fund manager with US$6.3 billion under management. Scott’s Liquid Gold is likely to own 2-4% of the combined entity. At a typical 3% EV/AUM, I get to a value of about US$5.7 million for the value of the stake in Horizon Kinetics, suggesting further upside to intrinsic value, perhaps as much as 100%.

Finally, have a look at the Tai Cheung idea. It’s a Hong Kong construction company turned property developer, now owning 35% of Sheraton Hotel in Tsim Sha Tsui. It also owns Metropole Square in Sha Tin and residential developments on the Peak and Repulse Bay. The stock now trades at 0.31x tangible book, about half of its historical average. The problem has been cap rate expansion but HIBOR is now peaking. I can vouch for the integrity of David Pun Chan, and the recent share buyback is a testament to his shareholder focus.

Americas:

Abilitato on Coca-Cola (🇺🇸 KO US - US$255 billion) (German language)

Value Don’t Lie: building materials company Atkore (🇺🇸 ATKR US - US$5.9 billion)

Meditation Capital on server SaaS firm HashiCorp (🇺🇸 HCP US - US$4.6 billion)

Bonhoeffer on North American Construction (🇨🇦 NOA CN - US$558 million)

Kairos Research on Mama’s Creations (🇺🇸 MAMA US - US$184 million)

Investing501 on Rocky Mountain Chocolate (🇺🇸 RMCF US - US$29 million)

No Name Stocks on Scott’s Liquid Gold (🇺🇸 SLGD US - US$12 million)

Europe, Middle East & Africa:

Antarctic Circle on serial acquirer BUFAB (🇸🇪 BUFAB SS - US$1.4 billion)

Desert Lion Capital on Argent Industrial (🇿🇦 ART SJ - US$45 million)

Asia-Pacific:

Bonsai Partners on Indian IT services co Nagarro (🇮🇳 NA9 GR - US$1.3 billion)

Patrimonie on Tai Cheung (🇭🇰 88 HK - US$261 million) (French language)

DMX Asset Management on Findi (🇦🇺 FND AU - US$39 million)

(estimated reading time)

A rare interview with Steven Mandel on how he invests and charities (38 mins)

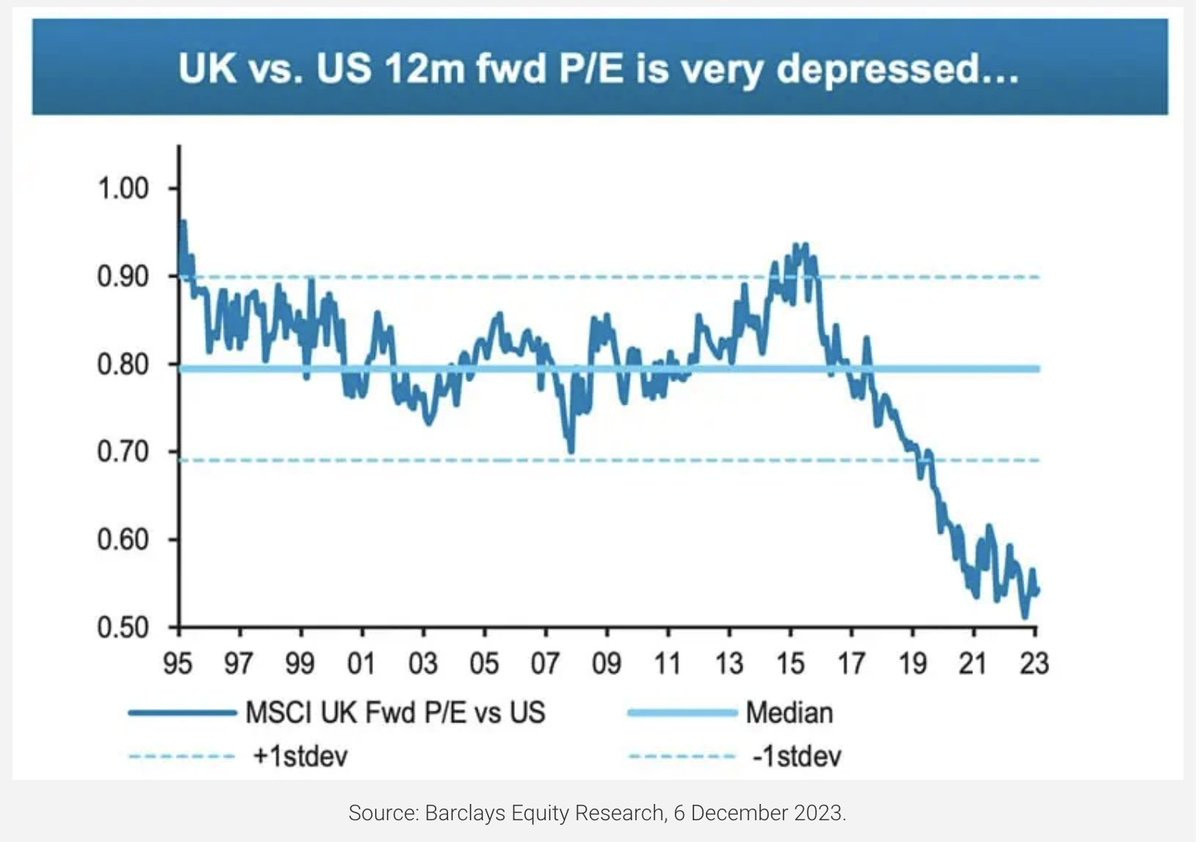

Great set of 2023 charts from Topdown Charts (click special report) (14 pages)

Jens Nordvig does a victory lap and argues that rates will fall further (2 mins)

Calafia Beach Pundit’s 2024 outlook: lower interest rates, no recession (6 mins)

Noah Smith applies the Solow model to China. TLDR: Stagnation ahead (9 mins)

Value & Opportunity: My 22 +1 investments for 2024 (12 mins)

Augustusville’s Top 29 stock picks for 2024 (12 mins)

Undervalued Shares: on the listed universe of central banks (18 mins)

(listening time)

Morgan Housel had a great episode with his top 10 financial skills, including preparing for the unexpected, marrying well, having a BS radar, etc. (16 mins)

Alberto Ayuso went on Value Hive to provide a shipping sector primer. He spoke about vessel replacement values, break-even rates and other tricks to gauge value. Favorite accounts: @mintzmyer, @calvinfroedge, @ed_fin (1:16 hours)

Adam Wilk on the potential turnaround of Canadian software developer Sylogist, which has been taken over by new CEO Bill Wood, who has a strong track record (59 mins)

Venture capital firm Altimeter Capital’s Brad Gerstner on identifying tech winners. Altimeter has a decent track record with a 30% CAGR (1:10 hours)

Disclaimer: Monday Morning Links uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers, including whether any investment suits your specific needs. From time to time, I may have positions in the securities covered in the articles on this website.