Monday Morning Links Week 51

Global stock-related links

Good Morning, this time from the USA! Michael has asked me to start contributing to Monday Morning Links, and I couldn’t be more honored. Quick background on me: I’m the author of ESG Hound, a compliance and due diligence-based publication. I have a background in regulatory and operational compliance in Industrials and Oil and gas, but I currently work in the US in financial markets and equity research.

Michael’s vision for this publication is to be global, informative, and interesting. His work on Asian equities is some of my favorite content, partly because it is so far removed from my core areas of focus and expertise. I hope to provide value here by expanding that base of expertise. Please let us know how it’s going: the good, the bad, the ugly.

With that out of the way, I’d like to start off with Capital Incentive’s excellent pitch on OSI Systems OSIS 0.00%↑. “Security” as an investment pitch has been, for far too long, nearly only focused on the purely digital (“cyber”) side of that equation. Physical security is often either too CapEx-heavy or has no real moat. The linked post makes an excellent case that OSI’s bundled, turnkey package of multiple technologies is differentiated, profitable, and likely to grow in the coming years. Doubly true at the end of this year, with the renewed global focus on Terrorism and political unrest. Some really great, in-depth analysis here.

I’m going to bang the table on this, but the back-and-forth, “will they or won’t they” debate over whether the COP28 Climate Summit agreements would include a statement on “Transitioning Away” from Fossil Fuels entirely misses the point. These COP agreements are always malleable, unenforceable, and primarily political affairs. Actions speak louder than words and on that front, last year’s Inflation Reduction Act opened the floodgates for renewable investment, but we haven’t seen the money flow just yet. Investors bid the Nasdaq 100 up 52% this year, but it’s shocking to me that American renewable energy and infrastructure adjacent stocks did not perform nearly as well. That’s where I’ll be focusing my long-side research going into 2024.

Americas:

Brad Hathaway (Far View Capital Management) on Distribution Solutions Group (🇺🇸 DSGR US - $US1.4 billion)

Value Don’t Lie on Unit Corp (🇺🇸 UNTC US - US$635 million)

Europe:

Maynard Paton on Lok’nStore (🇬🇧 LOK LN - US$335 million)

The Stock Engineer on Axkid AB (🇸🇪 AXKID SS - US$19 million)

Asia-Pacific:

Heritage in Actions on Tai Cheung Holdings (🇭🇰 88 HK - US$255 million)

WinterGems on AIT Corporation (🇯🇵 9381 JP - US$278 million)

(estimated reading time)

Robin Wigglesworth on the rise and fall (and rise) of successful large quant strategies. The story centers on Clifford Assness but is a fantastic insight into one of the least understood financial market topics. (20 mins)

Julian Evans-Pritchard on China’s economic outlook for 1Q2024. (3 mins)

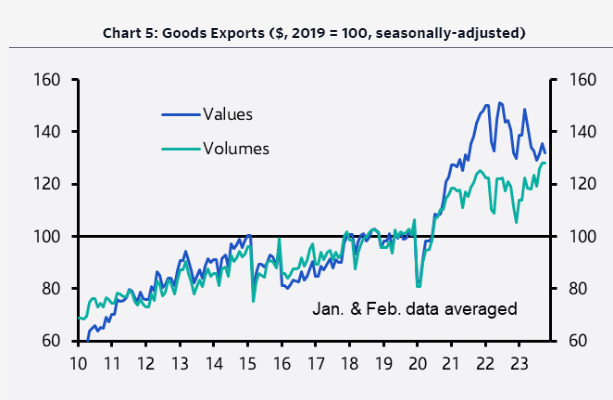

Note: I look forward to seeing how ongoing weakness affects export markets, particularly Europe, in 2024 (see chart of the week for more)

GaveKal on China’s economic integration with other emerging markets via the historical lens of other big growth markets (12 mins)

Michael Mauboussin’s new report on pattern recognition; when it works, but also how it can fail (15 mins)

Leo Perry’s beginner's guide to accounting fraud (Part 1, Part 2, Part 3, Part 4, Part 5 & Part 6)

(listening time)

Charlie Munger on Costco, crypto and mental models (1:41 hours)

My Worst Investment Ever Podcast On the importance of diversification. While nominally a more retail-focused episode, this one is a sobering reminder for professionals about putting aside ego and sticking to long-term, hedged and diversified investing (36 min)

Grant’s Current Yield with Guest Brent Donnelly on currency markets, flight to safety; plus a prediction that the current Japanese Yen consensus is the most likely FX trade to catch people offsides in 2024. (38 min)

The Security Analysis Podcast with George Livadas of Upslope Capital, on running a L/S Hedge fund in the US and a fun talk about his favorite “core” long, Ball Corp. (42 min)

Disclaimer: Monday Morning Links uses information sources believed to be reliable, but their accuracy cannot be guaranteed. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in such publications are those of the publisher and are subject to change without notice. You are advised to discuss your investment options with your financial advisers, including whether any investment suits your specific needs. From time to time, I may have positions in the securities covered in the articles on this website.